Welcome to Lefta Business Funding

Loans for Small Businesses

Get Funding OfferGET FUNDED IN 1-2-3 EASY STEP

Checking your rate won’t affect your credit score

Apply Online

Fast & Easy Online Application Our loan specialist will contact you Or call us at our phone number: (833) 750 0485

Review Your Options

You will have options to get funding in minutes

Get Funded!

Loans – $5,000 – $5,000,000 Receive funding in as fast as 1 day

FAST, EASY, RELIABLE

10,000+

Business Served

$2 billion+

Funds Delivered

Customer Reviews

FUNDING OPTIONS

Find the business loan that meets your needs

EQUIPMENT FINANCING

Get funding to purchase equipment for you business to keep on growing.

WORKING CAPITAL

Quick and simple cash available for any business purpose.

TERM LOAN

Our specialists will tailor a business loan to fit your needs.

SBA LOAN

Lowest rates available with an SBA 7a,504,or express loan.

BUSINESS LINE OF CREDIT

Access capital for your business when you need it and only pay interest on the funds you use.

INVOICE FACTORING

Get paid upfront for your 30-60 or 90 day old invoices.

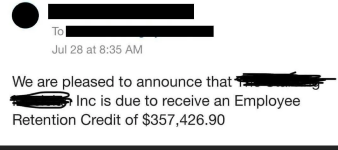

EMPLOYEE RETENTION TAX CREDIT (ERTC)

If your business had employees through 2020 and 2021 you may qualify for up to $26,000 per employee.

TRUSTED PARTNERSHIPS

WITH OVER 50+ LENDERS

EXCLUSIVE PARTNERSHIPS

THAT YOU CAN COUNT ON

At Lefta Business Funding, we appreciate how investing in relationships brings mutual prosperity. Who we partner with ensures the best services available for our customers.

To discuss potential opportunities, please call

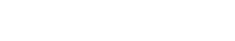

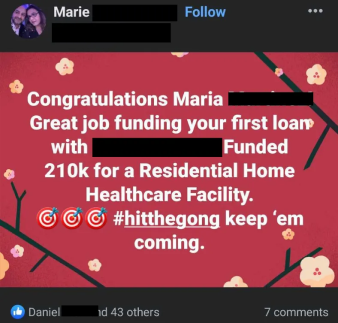

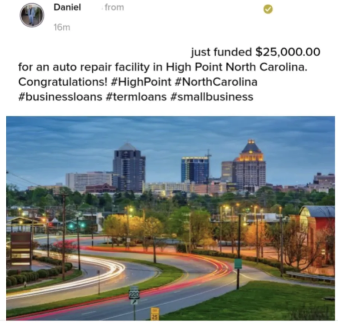

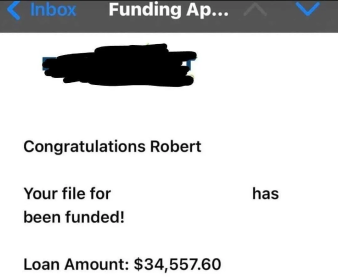

WHAT OUR CUSTOMERS ARE SAYING

Industry leading approval process that is easy and less intensive. Get the capital you need to allow your business to grow, today!

Speak to a Loan Specialist

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at Lefta Business Funding are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.

Loans for Start-Up Businesses Building Foundations for Success

Starting and growing a business requires determination, vision, and most importantly, access to capital. Lefta Business Funding is your trusted partner on the path to success, offering tailored financial solutions designed to support entrepreneurs like you every step of the way. Launching a new business is an exciting but challenging endeavor. As a start-up entrepreneur, you face numerous hurdles, not the least of which is securing the necessary funding to get your business off the ground. That’s where our start-up business loans come in. With flexible terms and competitive rates, our loans are designed to provide you with the capital you need to build a solid foundation for your business and turn your vision into a thriving reality.

Understanding Your Needs: Tailored Financing Solutions

We understand that every business is unique, which is why we take the time to understand your specific needs and goals before offering a financing solution. Whether you’re looking to invest in equipment, hire additional staff, or launch a marketing campaign, our team of experienced professionals will work with you to tailor a loan package that meets your exact requirements and sets you up for long-term success.

Loans for Small Businesses: Driving Growth and Innovation

Small businesses are the backbone of our economy, driving innovation, creating jobs, and fostering vibrant communities. At Lefta Business Funding, we’re proud to support the growth and prosperity of small businesses across the country. Our small business loans are designed to provide entrepreneurs like you with the financial resources they need to expand their operations, increase their market share, and achieve their business goals.

Instant Business Loans: Seizing Opportunities in Real-Time

In today’s fast-paced business environment, timing is everything. That’s why we offer instant business loans designed to provide you with rapid access to funds when you need them most. Whether you’re looking to capitalize on a time-sensitive opportunity, address an unexpected expense, or bridge a cash flow gap, our streamlined application process and expedited approval timelines ensure that you can seize opportunities in real-time and keep your business moving forward with confidence.

Online Business Loans Convenience at Your Fingertips

In today’s digital age, convenience is key. That’s why we’ve made it easier than ever to apply for a business loan online through our website. With just a few clicks, you can complete our secure application form from the comfort of your home or office, eliminating the need for time-consuming paperwork and in-person meetings. Our online platform connects you with a network of trusted lenders and lending partners, ensuring that you find the financing solution that best fits your needs – all with the convenience and efficiency you deserve

Our Mission: Fueling Your Dreams

At Lefta Business Funding, our mission is clear: to empower entrepreneurs by providing them with the financial resources they need to bring their business ideas to life. We believe that every entrepreneur deserves the opportunity to pursue their dreams, and we’re committed to helping make those dreams a reality through our innovative lending solutions.

Transparency and Trust

At Lefta Business Funding, we’re more than just a lending company – we’re your partners in success. Whether you’re a start-up entrepreneur with a big idea or a small business owner looking to take your company to the next level, we’re here to provide you with the financial resources and support you need to achieve your goals. Let us help you turn your dreams into reality – contact us today to learn more about our innovative lending solutions and how we can help you build a brighter future for your business.

Building Strong Relationships with Lenders:

Once you’ve identified a suitable loan option from a lender connected through Lefta Business Funding, here are some tips for fostering a positive and productive relationship:

- Be Prepared: Gather all the necessary documentation requested by the lender beforehand. This demonstrates your professionalism and expedites the loan approval process.

- Open Communication: Maintain clear and consistent communication with the lender throughout the entire process. Address any questions or concerns promptly.

- Transparency is Key: Provide accurate and complete information in your loan application. Honesty and integrity are essential in building trust with your lender.

Beyond Loan Approval Ensuring Long-Term Success

Securing financing is a crucial step, but it’s just the beginning of your journey. Here are some additional tips to ensure long-term financial success for your small business:

- Develop a Comprehensive Business Plan: A well-defined business plan serves as a roadmap for your business growth. It outlines your goals, strategies, and financial projections, demonstrating to lenders your commitment to success.

- Meticulous Financial Management: Implement sound financial management practices. Track your income and expenses diligently, create a budget, and monitor your cash flow.

- Building a Strong Credit History: Maintaining a good credit history is essential for securing future financing with the most favorable terms. Make loan payments on time and strive to reduce existing debt.